Our business is global in nature, and a significant part of our work is conducted in English – but GRCO is primarily based in Germany.

Consequently, German language skills, to at least B2 level, are a key requirement for joining our team. Which explains why our job postings, like the one below, are a deliberate break from the overall theme of this website.

Senior Consultants & Engagement Managers,

Governance Risk & Compliance

GRCO ist eine Unternehmensberatung mit Büros in Frankfurt, London und Luxembourg. Als Boutique mit Spezialisierung in den Bereichen Governance, Risk, Accounting und Compliance bieten wir unseren Kunden in der Finanzindustrie maßgeschneiderte Lösungen. Unser Ziel ist es, unsere Kunden in einer Welt des stetigen Wandels in diesen Themenbereichen langfristig orientiert zu unterstützen. Auch im Hinblick auf unsere Mitarbeiter setzen wir auf langfristig orientierte Beziehungen.

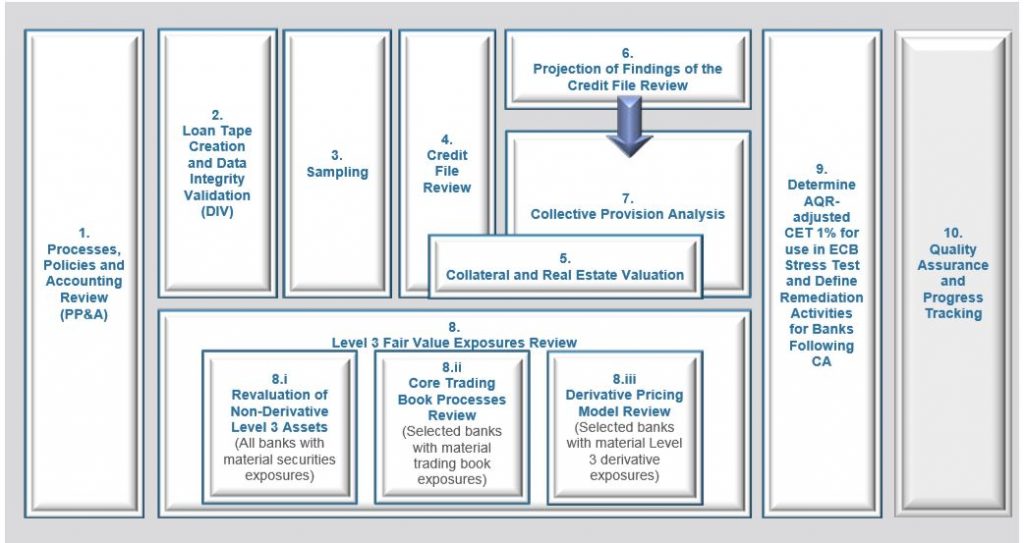

Unsere Themen sind vielfältig und geprägt von aktuellen regulatorischen Anforderungen. Beispielsweise unterstützen wir unsere Kunden in folgenden Bereichen: Brexit, FINREP / COREP, Asset Quality Review, Stress Testing, Local ICAAP, Sanierungsplan (MaSan / Living Wills), IFRS 9, AnaCredit, BCBS239, Asset Encumbrance, Supervisory Review and Evaluation Process (SREP) sowie die Umsetzung des Single Supervisory Mechanism.

Zur Verstärkung unseres Teams in Frankfurt suchen wir erfahrene Berater und Engagement Manager (w/m) mit dem folgenden Profil:

- Mindestens zwei Jahre Berufserfahrung in einer projekt- oder mandatsorientierten Umgebung, insbesondere in der prüfungsnahen Beratung

- Sicheres Auftreten im Umgang mit Führungskräften, Überzeugungsfähigkeit und Kommunikationsstärke

- Eigeninitiative und strukturierte, zielorientierte Arbeitsweise

- Dezidierte Erfahrung in der Finanzindustrie mit Schwerpunkt in den Bereichen Governance, Risk oder Compliance, beispielsweise: Market, Credit oder Counterparty Risk, Operational Risk, Living Wills und Sanierungsplanung, Regulatory Compliance, Anti-Financial Crime

- Grundlegendes Verständnis relevanter Arbeitsprozesse unserer Mandanten

- Kenntnisse eines typischen Anwendungssystems aus dem Bereich Handelssysteme, Risikomanagementsysteme oder ERP Systeme (insbesondere hinsichtlich bankrelevanter Module)

- Erfahrung in der Modellierung von Arbeitsprozessen und / oder der Erstellung fachlicher Anforderungskataloge

- Sehr gute englische Sprachkenntnisse sind erforderlich, Kenntnisse der französischen Sprache sind von Vorteil

Den passenden Kandidaten wiederum bietet Gutmark, Radtke & Company als Arbeitgeber die folgenden Vorteile:

- Mitarbeit an der Lösung komplexer Probleme, die eine Kombination aus Fachwissen, Kreativität und Strukturierungsfähigkeit erfordern

- Tätigkeit in einem eignergeführten Unternehmen mit Teamgeist, kurzen Entscheidungswegen, minimaler Hierarchie und enger Kommunikation

- Aufträge bei großen, internationalen Mandanten

- die Möglichkeit der Arbeit im europäischen Ausland, insbesondere in London und Luxembourg

- Schnelle Übernahme von Verantwortung für Mandanten, Themen und Mitarbeiter

- Überdurchschnittliche Vergütung mit transparentem Erfolgsanteil

Sollte das Profil unserer Firma für Sie ansprechend sein, und wenn Sie wiederum dem Profil unserer Mitarbeiter entsprechen, dann freuen wir uns, umgehend von Ihnen zu hören. Senden Sie Ihre Unterlagen einfach an bewerber@dev.gutmark.net.