The Challenge: Portfolio Relocation

While uncertainty around Britain’s exit from the EU remains, many financial institutions are beginning to act on their contingency plans. And some of those plans involve moving large portfolios of assets to locations within the Eurozone.

But what if this leads to a previously “less significant institution” based in the Eurozone breaching the EUR 30 bn barrier and suddenly becoming a “significant institution” under ECB oversight?

The Onboarding Process

In this case, an onboarding procedure is triggered, as part of which the ECB will perform an initial health-check for the institution in the form of an Asset Quality Review (“AQR”). The AQR process aims to enhance transparency of bank exposures, including the adequacy of asset and collateral valuations.

For more detailed information on ECB expectations regarding a relocation to the Eurozone, you can also refer to the ECB’s own excellent Q&A section on this topic.

Onboarding & the Asset Quality Review

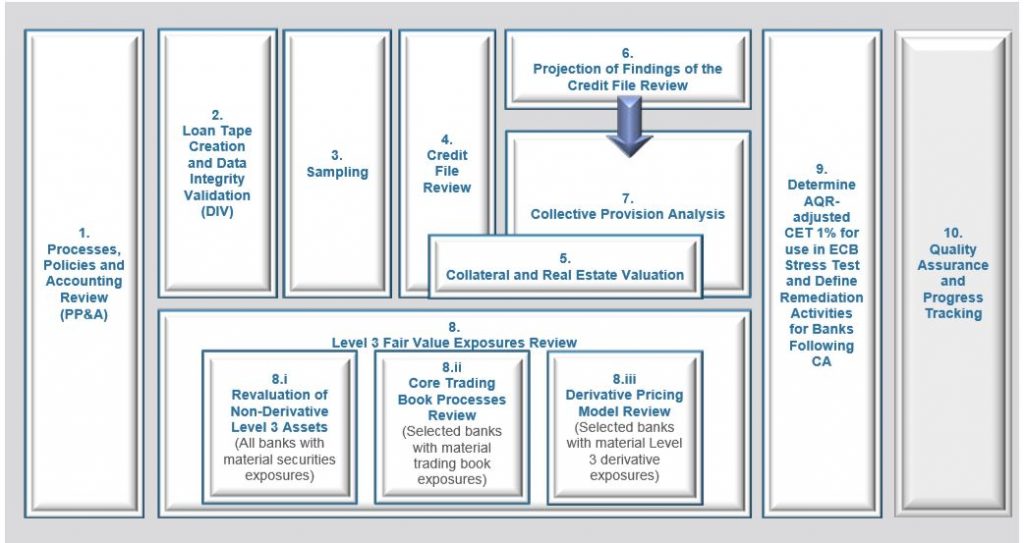

Put into further context, the AQR is carried out as a one-off exercise at onboarding, but it is also repeated in regular intervals as part of the Comprehensive Assessment (“CA”) performed by the ECB and the National Competent Authorities (“NCAs”). The CA effectively consists of the AQR combined with a stress test. But let us first focus on the AQR as part of the onboarding process. The following chart illustrates the ten key areas (“workblocks”) of the AQR, which are explained in more detail in the ECB’s AQR Manual.

Source: ECB, Asset Quality Review, Phase 2 Manual (June 2018)

Of the ten workblocks shown above, the first step, the review of processes, policies and accounting practices (“PP&A”), is of particular importance. It is a vital exercise to prepare a bank’s readiness for the on-site inspection by the Joint Supervisory Team (“JST”). In this context, the policies, procedures and accounting practices governing the following areas need to be documented and evaluated:

- Classification of financial instruments

- Application of fair value hierarchy

- Provisioning

- Impairment of staging criteria

- NPE definitions

- Forbearance and restructuring

- Collateral valuation and disposal processes

- CVA calculation

- Group of connected clients and country of ultimate borrower

- Deconsolidation processes

- Creation or reserves of legal costs

Our Experience

This initial workblock of the AQR will already help to shape regulatory focus – and it is therefore of particular importance to get it right. And this is an area where GRCO has substantial experience, working with clients currently going through Brexit-related onboarding processes. With our experience, we can help your organisation plan, prepare and execute your part of the AQR process in a timely and efficient manner.

For further information on our experience, please do not hesitate to contact our colleagues Dr Benny Gutmark or Torsten Tegtmeier.